Ebitda margin formula

For instance suppose a company has generated the following results in a given period. But the average EBITDA margin for the SP 500 in the first quarter of 2021 stood at 1568Looking closer into individual companies the EBITDA margin of Coca-Cola during the fourth quarter of 2020 stood at 983.

Ebitda Margins What Every Small Company Owner Needs To Know

A good EBITDA margin is largely dependent on the industry.

. Operating margin is a margin ratio used to measure a companys pricing strategy and operating efficiency. The formula is as follows. This is the revenue from operations minus operating expenses including the cost of goods sold overhead depreciation and amortization.

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. The components of EM are.

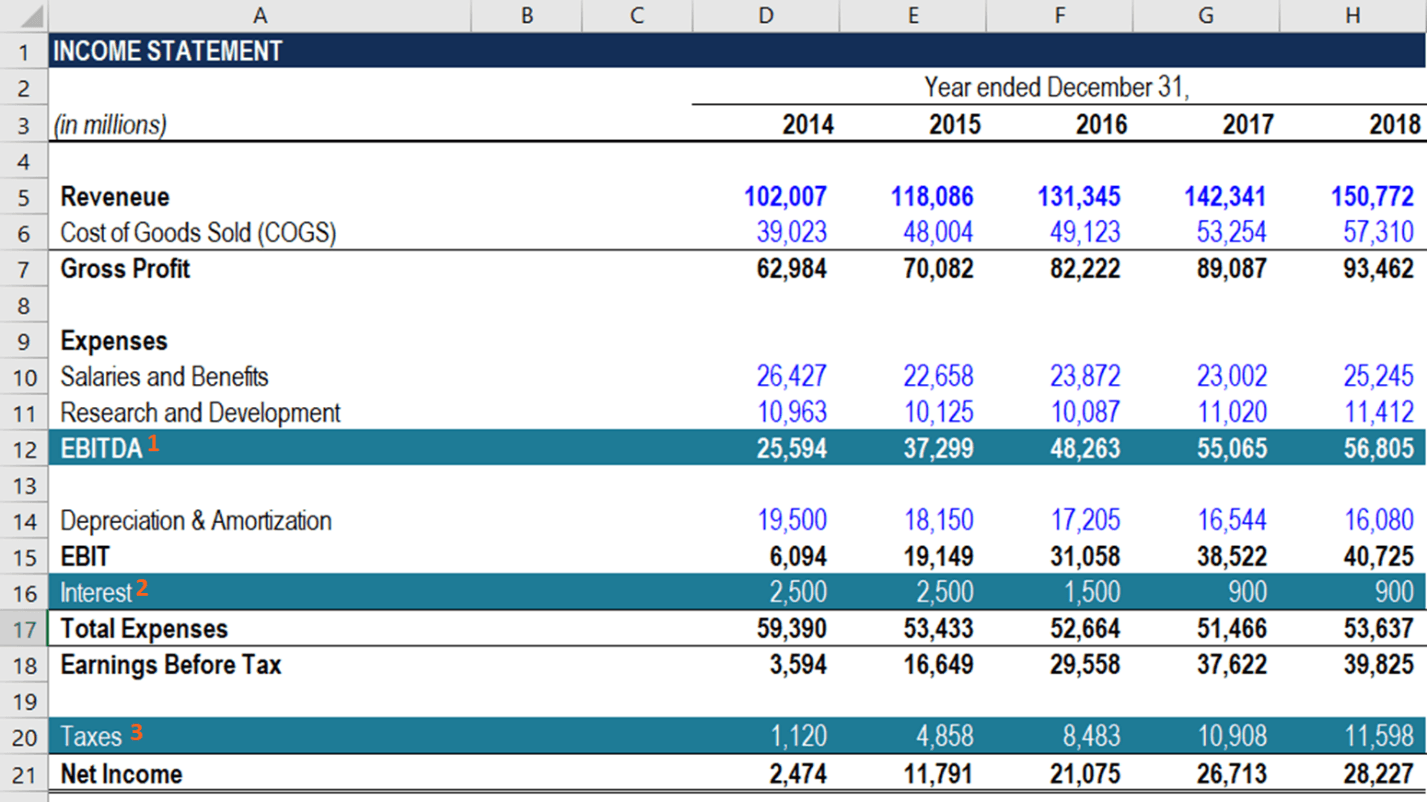

Operating Activities includes cash received from Sales cash expenses paid. However in 2015 Colgates EBIT Margin EBIT Margin EBIT Margin is a profitability ratio that is used to determine how successfully and efficiently a business can manage its operations. Cost of Goods Sold Direct Costs.

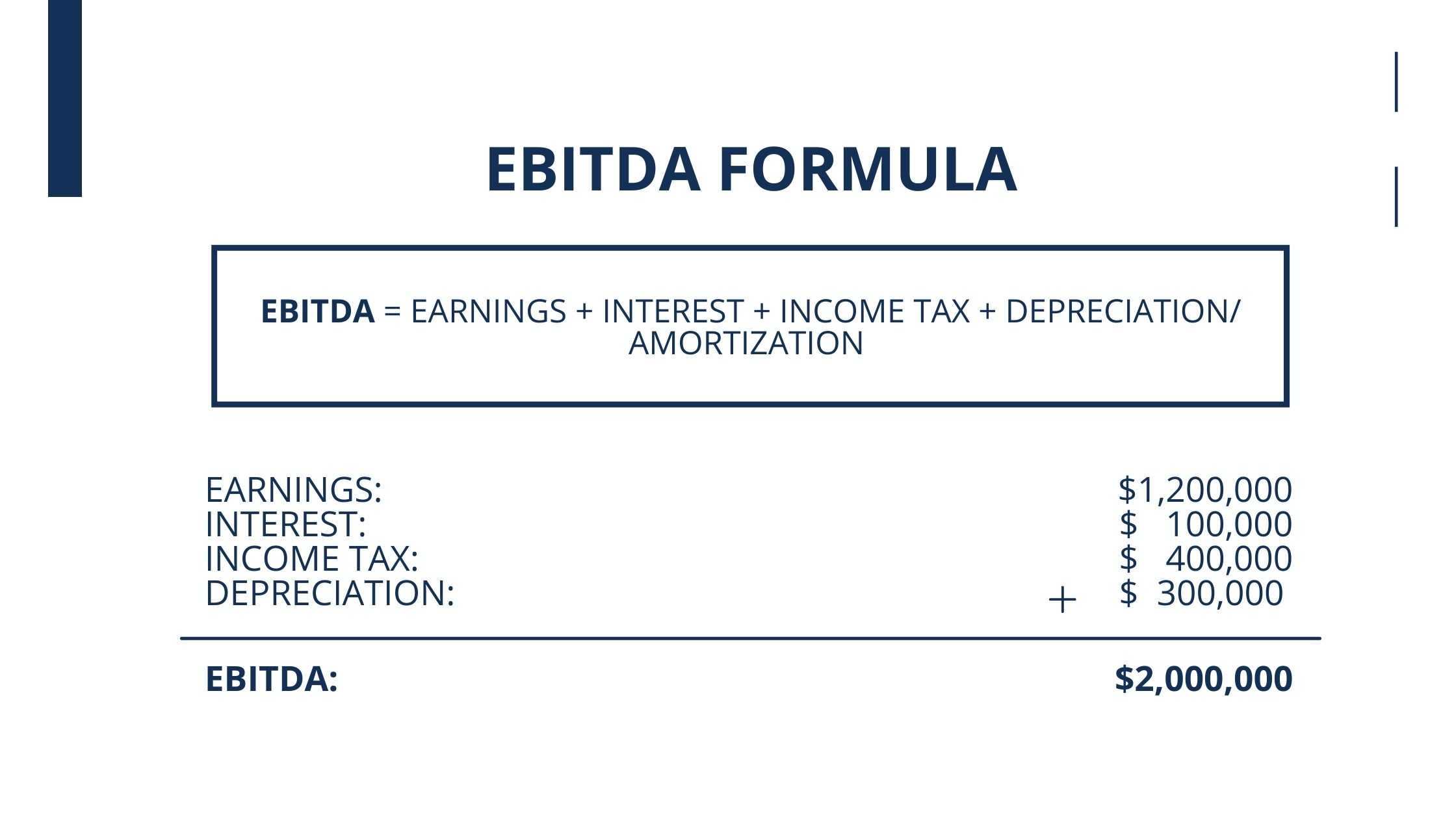

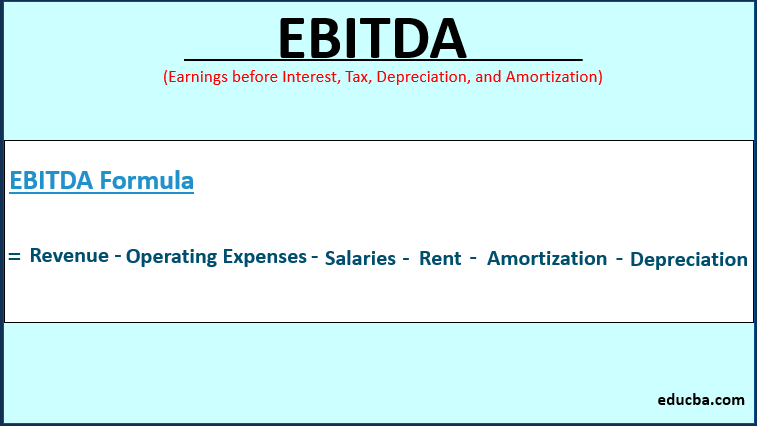

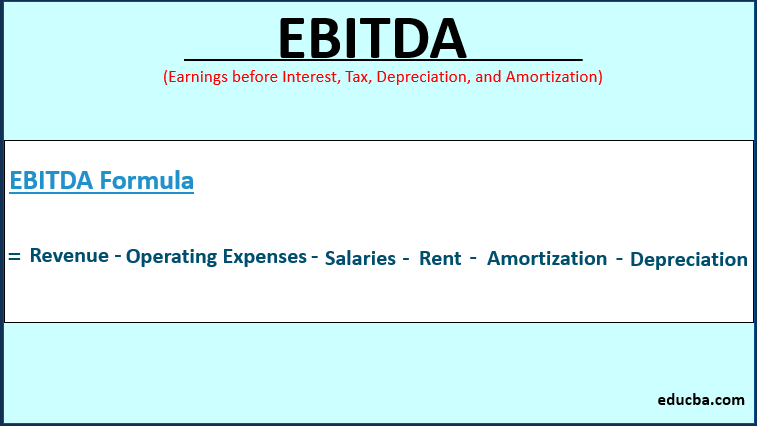

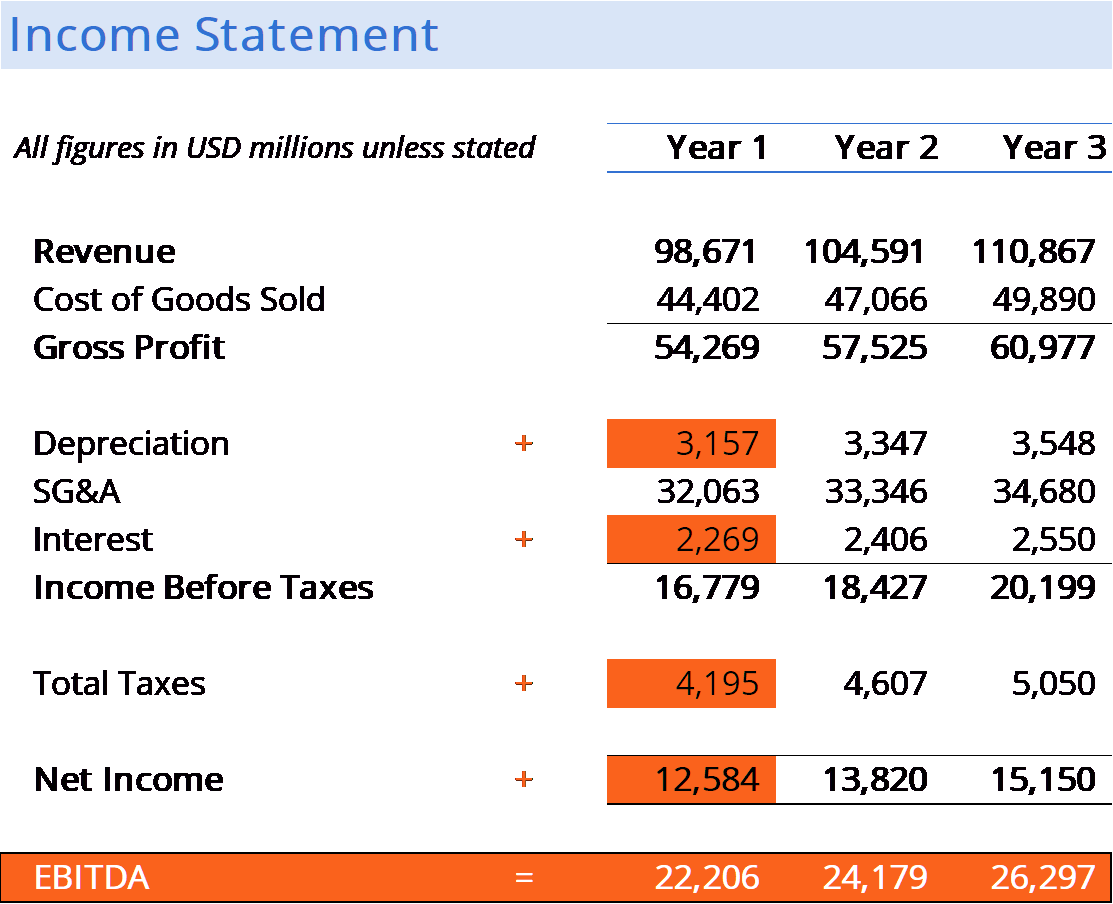

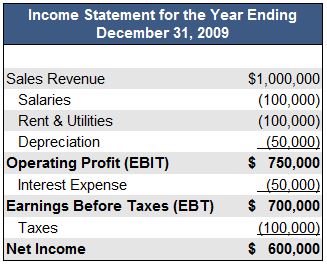

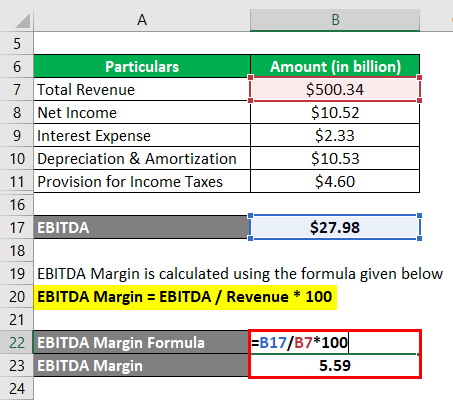

The term EBITDA is the abbreviation for Earnings before interest tax and depreciation amortization and as the name suggests EBIDTA refers to the companys earnings before deduction of interest tax and depreciation amortization. To compute the EBITDA ratio the following formula is used. The formula for calculating the EBITDA margin is as follows.

A good EBITDA margin or valuation metric will depend on the industry the company operates in. EBITDA total revenue. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

EM Operating Income Depreciation Amortization Total Revenue. For the year ended. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm.

LMN company declared a net profit before taxes and interest of 3M for year-end 2015. It is calculated by. 500000 5000000 10.

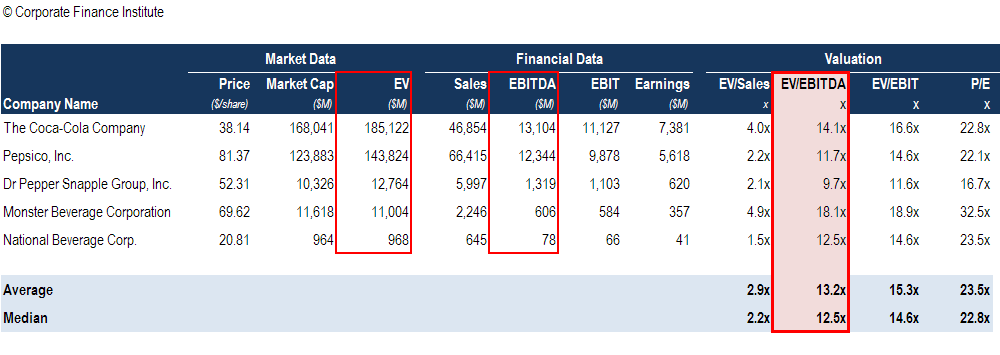

EBITDA Multiple Enterprise Value EBITDA. EBITDA - Earnings Before Interest Taxes Depreciation and Amortization. EBITDA stands for earnings before interest taxes depreciation and amortization.

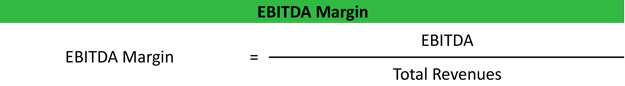

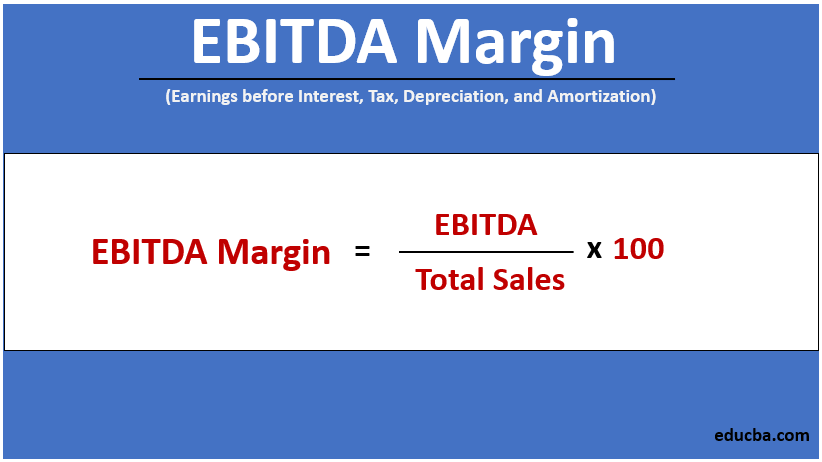

The formula for an EBITDA margin is as follows. The EBITDA margin formula is. EBITDA Margin EBITDA Net Sales.

EBITDA is one indicator of a companys. Importantly operating income. These margins can be compared to those of competitors like Lowes LOW to measure the relative operating efficiency of the businesses.

Firstly one can capture the net income from the income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and expenses over time in order to determine the. EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. What is the EBITDA formula.

By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. Finally the formula for a current yield of the bond can be derived by dividing the expected annual coupon payment step 1 by its current market price step 2 and expressed in percentage as shown below. It is equal to earnings before interest tax depreciation and amortization EBITDA.

To see how EBITDA margins help compare the profitability of similar companies lets take a look at two startups selling the same product. Startup A is funded by debt and incurs interest payments while Startup B. EBITDA Formula Table of Contents Formula.

The numerator the enterprise value EV calculates the total value of a companys operations whereas EBITDA is a widely used proxy for a companys core ie. The EBITDA margin formula is. Adjusted EBITDA Earnings Before Interest Taxes Depreciation and Amortization is a measure computed for a company that looks at its top line earnings before deducting interest expense taxes.

EBITDA was 2080 billion and the EBITDA margin was 1376. Operating margin gives you the ratio of income to expenses. Seth Klarman Commentary on EBITDA Source.

Gross Margin Formula Example 2. To learn more launch our online finance courses now. EVEBITDA Enterprise Value EBITDA.

Gross Margin 38. What is a Good EBITDA margin. EBITDA is an important valuation tool because it is used as a proxy for operating cash flows Operating Cash Flows Cash flow from Operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating business in an accounting year.

Using the second method the calculation of EBIT margin formula can be done using the following steps. EBITDA margin EBITDA Total Revenue. EBITDA Margin EBITDA Revenue.

Unlevered operating cash flows. The EBITDA formula measures a companys profitability using items from the income statement. Relevance and Use of Current Yield of Bond Formula.

To Determine the Enterprise Value and EBITDA. Let us see the EBITDA Margin calculation The EBITDA Margin Calculation EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the companys operating profitability and cash flow position. EBITDA can also be compared to sales as an EBITDA Margin.

The formula for EBITDA. A companys profitability can be measured in several ways including common calculations such as operating margin and EBITDA. We can represent contribution margin in percentage as well.

Net sales reported in the income statement shows an amount of 5M. If your business has a larger margin than another it is likely a professional buyer. EBITDA total revenue EBITDA margin For example lets say Company A has an EBITDA of 500000 along with a total revenue of 5 million.

To find out if your EBITDA margin is any good its. Read more decreased significantly to 174. Current Yield Annual Coupon Payment Current Market Price of Bond 100.

EBI Earnings Before Interest Expense. A higher EBITDA margin indicates a companys operating expenses are smaller than its total revenue which leads to a profitable operation.

Gross Profit Margin Formula And Calculator Excel Template

How To Calculate Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

How To Calculate Fcfe From Ebitda Overview Formula Example

Gross Profit Margin Formula And Calculator Excel Template

Ebitda Multiple Formula Calculator And Use In Valuation

Contribution Margin Formula And Ratio Calculator Excel Template

Ebitda Types And Components Examples And Advantages Of Ebitda

What Is Ebitda Formula Definition And Explanation

Sjcomeup Com Calculator Ebida

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Definition Formula Example

:max_bytes(150000):strip_icc()/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

How Do I Calculate An Ebitda Margin Using Excel

Ev Ebitda Multiple Formula And Calculator Excel Template